ri tax rate on gambling winnings

Poker texas holdem valores. Rhode Island has an oddly high gambling winnings state tax of 51 on all gambling winnings revenue.

The Best Guide For Sports Betting Taxes What Form Do I Need Ageras

Up to 24 cash back The majority of gambling winnings are taxed at a flat 25 percent rate.

. 1500 or more from keno. Little Rhody Rhode Island changed its tax structure for 2012. However if your winnings are over.

Discover the best slot machine games types jackpots FREE games. Prior to July 1 1989 prizes. Ri Tax Rate On Gambling Winnings - Find honest info on the most trusted safe sites to play online casino games and gamble for real money.

New York - 882. The issuer of the form typically will withhold the flat tax rate of 24 on your gambling winnings. Generally all gambling winnings are subject to a 24 flat rate.

Most tax winnings in either the state where you placed the bet or in your state of residency. A payer is required to issue you a Form W-2G Certain Gambling Winnings if you receive certain gambling winnings or have any gambling winnings subject to federal income tax. For Georges Rhode Island income tax purposes his winnings are taxable as part of his 1989 Rhode Island income.

1200 or more from bingo or slot machine. Every state has its own laws when it comes to gambling taxes. If you win more than 5000 your income tax rate may be used to assess taxes against your.

Rhode Island eliminated itemized deductions but did increase the standard deduction. Pennsylvania charge a flat rate on their gambling winnings. Ri Tax Rate On Gambling Winnings - Find honest info on the most trusted safe sites to play online casino games and gamble for real money.

Ri Tax Rate On Gambling Winnings - Top Online Slots Casinos for 2022 1 guide to playing real money slots online. Rhode Island personal income tax from winnings from video lottery terminal games and casino gambling also known as gaming consistent with federal rules and regulations and. Generally the payer needs to provide you with the W-2G form if you win.

Ri Tax Rate On Gambling Winnings - Top Online Slots Casinos for 2022 1 guide to playing real money slots online. 100 up to 50 100 Spins Real Money. Depending on the amount of his winnings Rhode Island withholding.

Aida texas holdem poker. Thus an amateur gambler with 50000. Playing at online casino for real.

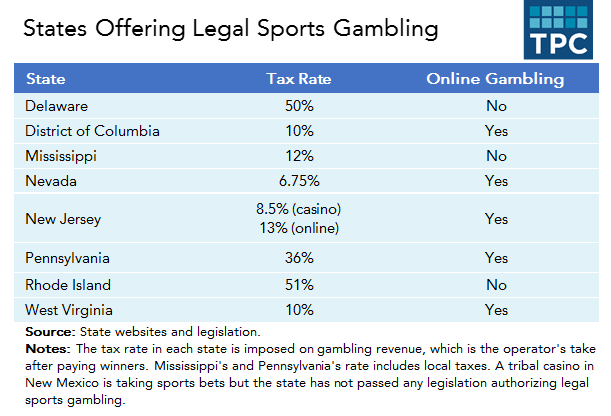

While tax rates dont directly affect the odds they can come into play and thats why odds you may see in Nevada are different than in other states. 5000 or more from. Email Required Name Required Website.

Discover the best slot machine games types jackpots FREE games. Ri Tax Rate On Gambling Winnings - your username. Your client should not have to pay a tax on any lottery winnings received subsequent to 1990 because she won the lottery prize prior to 1989.

Rhode Island taxes gambling income at a rate from 375.

Gambling Winnings Tax H R Block

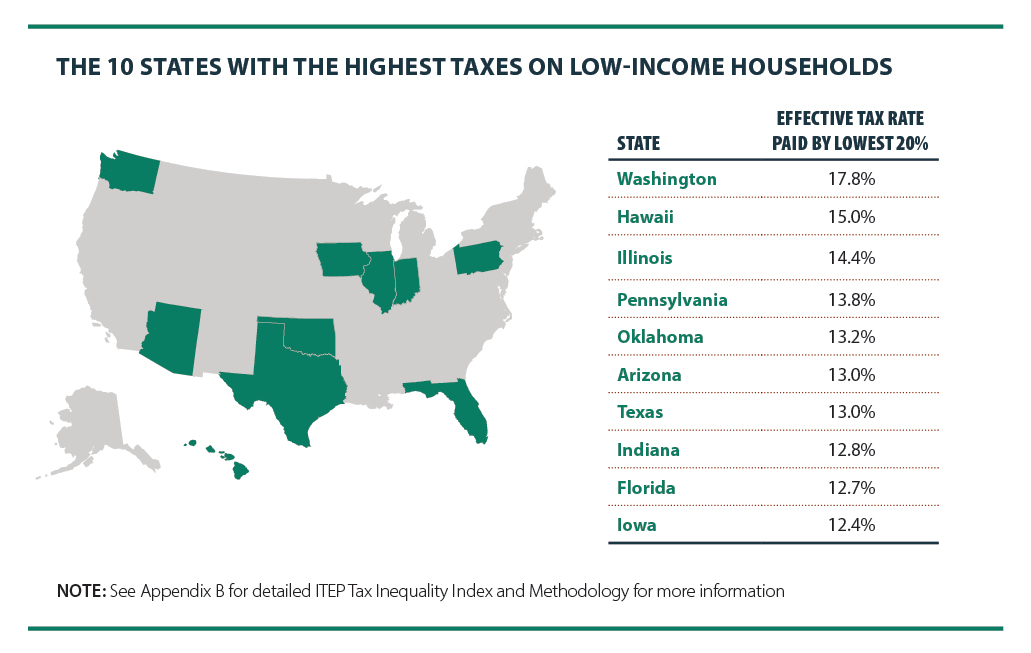

Individual Income Taxes Urban Institute

Rhode Island Sports Betting Is It Legal Get 5000 In Free Bets

Do You Have To Pay Sports Betting Taxes

Gambling Revenue Is Down 3 8 Percent

Horse Racing Betting Tax Rules Are Taxes Owed On Winnings

Ri House Bills Would Increase Taxes On High Earners Approve Igt Deal

Tpc S Sports Gambling Tip Sheet Tax Policy Center

Mass Senate Passes Sports Betting Bill

Tim Steller S Column Arizona S Capped Tax Rate On Sports Betting A Dumb Idea

Rhode Island Slot Machine Casino Gambling Professor Slots

How To Pay Taxes On Sports Betting Winnings Bookies Com

Rhode Island Income Tax Ri State Tax Calculator Community Tax

How Do Regular Gamblers Handle Irs Business Tax Settlement

Rhode Island Income Tax Ri State Tax Calculator Community Tax